July 08, 2021

The Ultimate Guide to Applying for a Small Business Loan

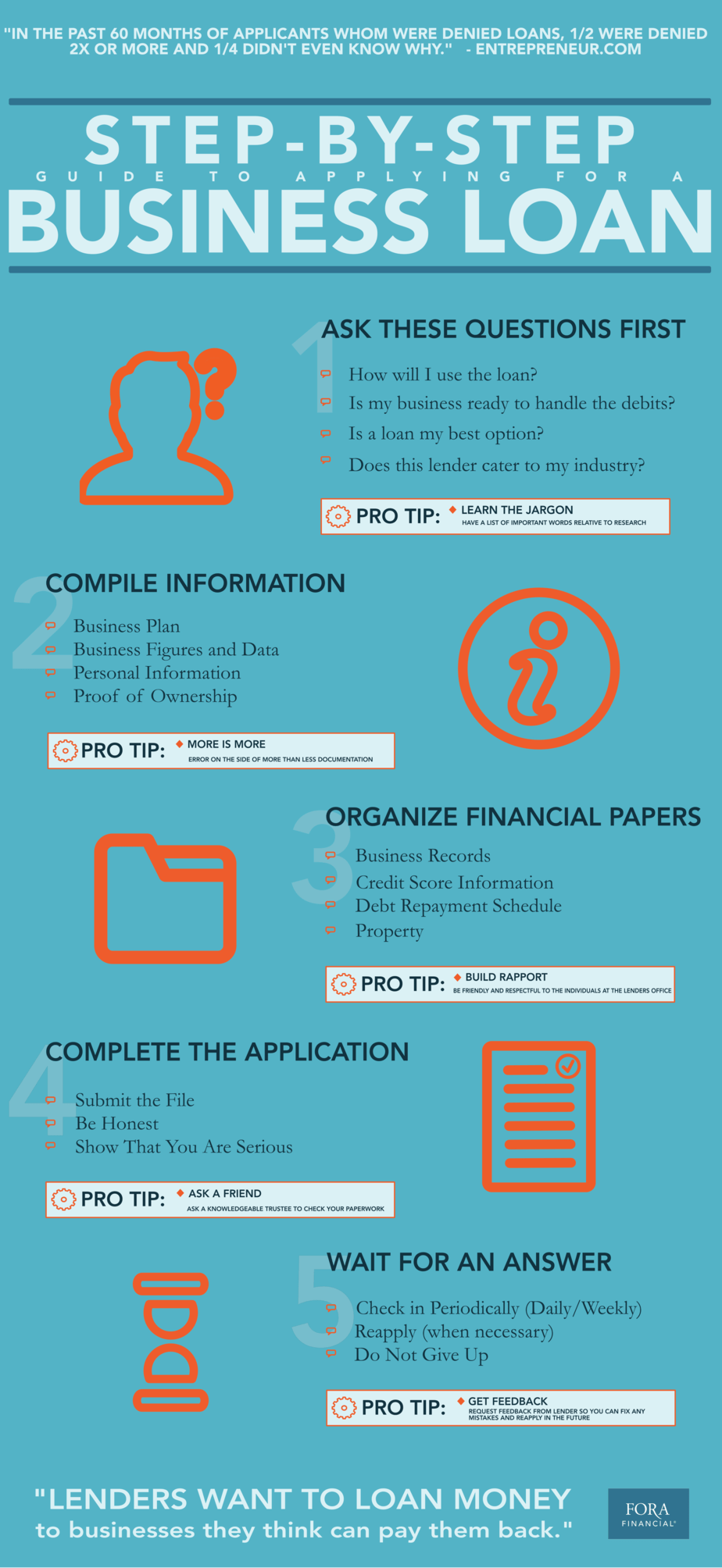

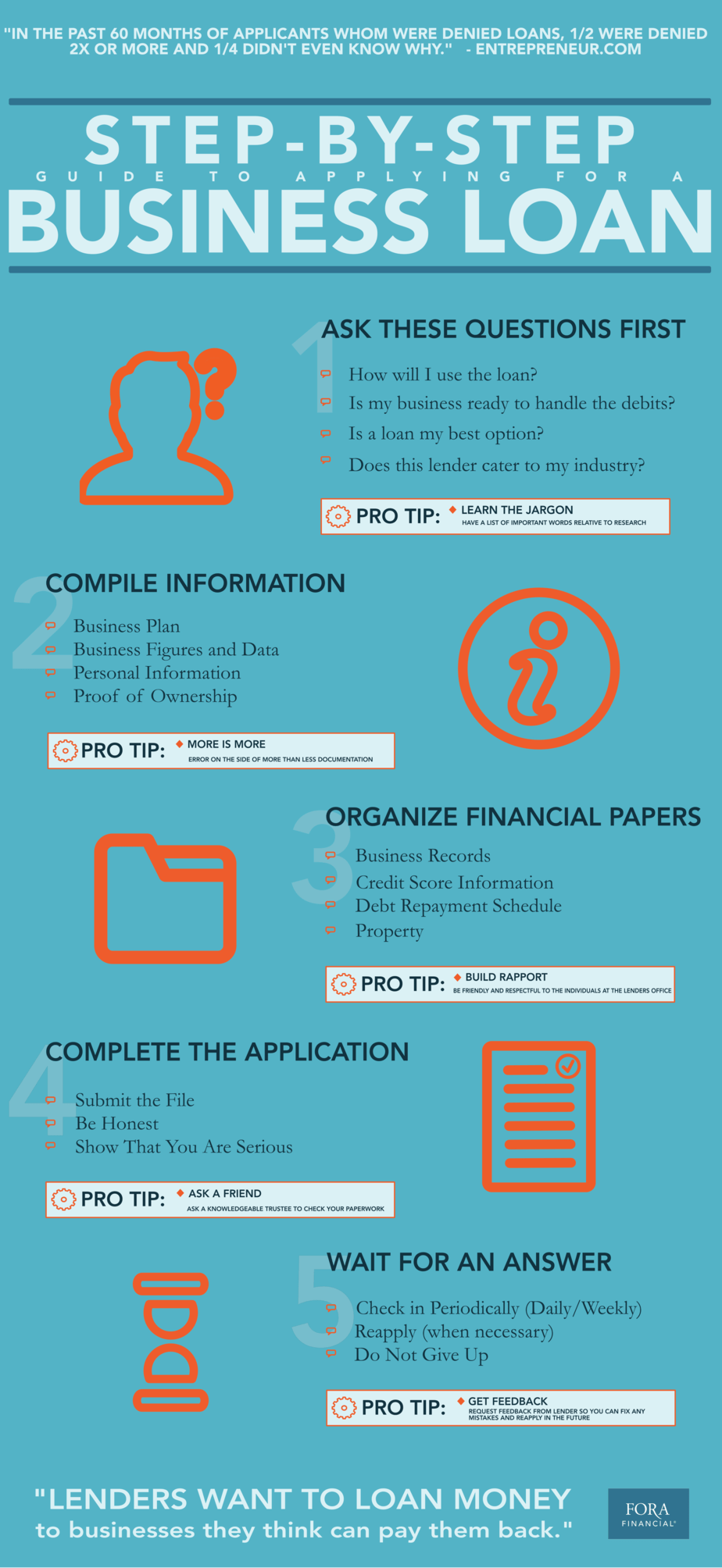

In this post, we’ll review the steps you should take to apply for a small business loan. After completing these five steps, you should be able to get approved for a loan amount that best fits your business needs.

How to Apply for a Business Loan:

1. Answer These Frequently Asked Questions

Before you apply, you should consider why you’re pursuing a small business loan. Are you planning to expand, or perhaps you need additional cash flow or want to pay off debts? By knowing how you plan to use a loan can help you determine how much you’ll need, which can be helpful for a lender to know. Next, you should ask yourself if you’re prepared to take on a business loan. A loan provides a cash influx, but it’s also a debt until you pay it back. You’ll have the best chance of landing a loan when your business is performing strongly. Therefore, if you have significant business credit card debt or other outstanding balances, you might want to apply for a loan once you've repaid your debt. Lastly, ask yourself if you’ve considered all financing options. Compare multiple business lenders, and consider their offers before applying. It’ll take some time, but you should search for loan terms that best fit your needs. For instance, if you have long-term goals, a short term loan might not be the best fit for you. Once you’ve asked yourself these questions, do your due diligence and read reviews from other borrowers about each lender. This will help eliminate any bad apples and allow you to be confident in your decision. In addition, make sure your industry qualifies for the loans you’re leaning toward. Some fields, like construction companies, clinics, and nonprofits have restrictions from both the federal government and financial institutions.2. Compile Business and Personal Information

Before applying, you should have a clear business plan that explains how you’ll utilize a loan. In addition, you should provide information relating to your business’s figures, like your year of inception, last year’s profits, and monthly sales amount. Every lender’s requirements will differ, and you may have to submit documents such as:- A personal statement

- Personal credit report

- Criminal record

- Previous legal names

- Previous addresses

- Other financial documents

- Schedule Cs

- Articles of incorporation

- Share certificates

- Articles of organization

3. Organize Your Financial Statements

In your application, most lenders will require financial documents like:- Accounts receivables

- Balance sheets

- Bank statements

- Multiple time-span profits and loss statements

- Tax returns.

- Rent/real estate schedule

- Percent ownership documentation

- Tax payments

- Monthly payments

- Anything else that would help inform your application

4. Complete the Loan Application Process

It’ll take time and effort to organize required paperwork, but package it into a nice file. Show the lender that you're conscientious and taking the process seriously. Alternatively, the lender may prefer that you submit an online application. On your application, be honest about your debts, past businesses, and any other relevant information. If your application includes any false information, your application will likely be rejected. In addition, it might be worthwhile for you to have a colleague or business partner review the application to ensure that you don’t miss anything.

5. Wait for an Answer (And Try Again if You Don’t Succeed)

Some online lenders can inform you if you qualify for a term loan within 24 hours, but many traditional lenders will take two to six weeks to analyze your application. You may need to provide more documentation along the way, so make sure to get back to the lender quickly if they follow up. Ultimately, the waiting period depends on your chosen lending institution and application strength. If you find out that you’ve qualified for a business loan, that is great news for your business's operations! It’s very exciting to receive financing for your business. However, be sure to review the loan agreement before finalizing the process. That way, you’ll be fully aware of the loan terms prior to committing to the financing option. Remember, if you don’t qualify for a loan, ask the lender for feedback on your application and use it to improve your approach when re-applying. For instance, if they say your business or personal credit score is too low, you can take time to improve your score before applying again. If you still can’t get approved for financing, you may want to contact the Small Business Administration (SBA). They provide loans to business owners that can’t qualify for traditional financing. Therefore, if you can’t get approved for a loan from an alternative lender, SBA loans are still an option!Conclusion

As a small business owner, it’s crucial that you make responsible financial decisions. When applying for a business loan, be sure to follow the steps in this post. You’ll be more likely to qualify for a loan and can be confident that you’ve selected the best option for your business. If you’ve received a business loan, share your application tips with us in the comment section below! Editor’s Note: This post was updated for accuracy and comprehensiveness in July 2021.